The trends in your business should inform your decision when determining the most appropriate range. The chart should contain only one type of information in each segment; otherwise, there will be overlapping of information across segments, which can lead to potential inaccuracies during reporting. This is a thought experiment where you try to see if competent accountants unfamiliar with the details of your business can successfully close the book. It should also be possible for a concerned third party to understand the information provided in the COA without difficulty. In a large company, revenue can be subdivided according to the various divisions that generate it.

Category

- Learn how to build, read, and use financial statements for your business so you can make more informed decisions.

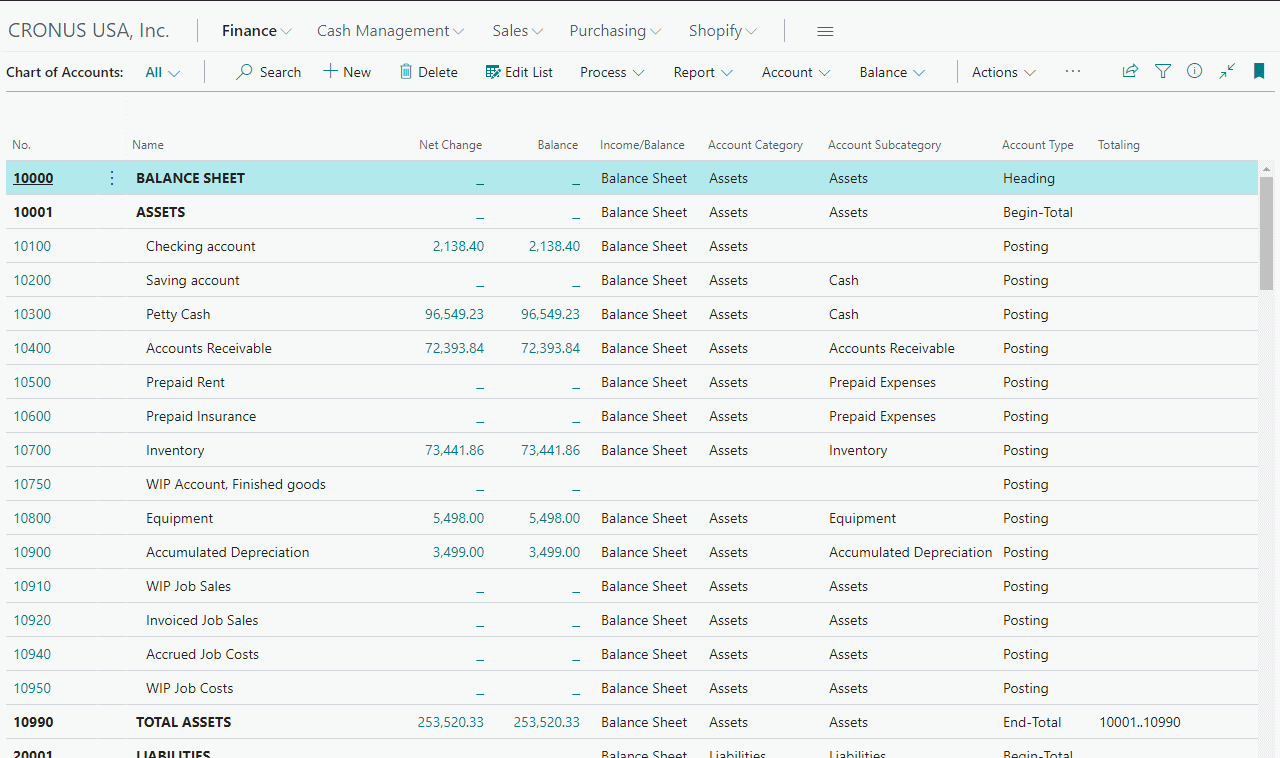

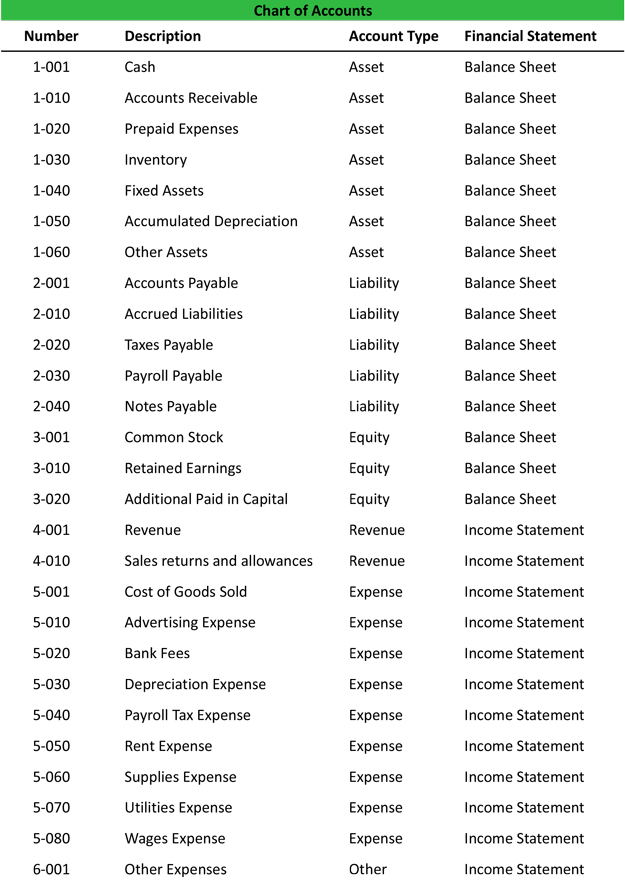

- The COA is usually hierarchical, with accounts organized in categories and subcategories.

- COAs are typically made up of five main accounts, with each having multiple subaccounts.

- The difference is that most businesses will have many more types of accounts than your average individual, and so it will look more complex; however, the function and the concept are the same.

In any case, the chart of accounts is a useful tool for bookkeepers in recording business transactions. Accounts are classified into assets, liabilities, capital, income, and expenses; and each is given a unique account number. Having a Chart of Accounts allows businesses to easily track their financial transactions, generate meaningful financial reports, and maintain compliance with applicable regulations.

Account Numbering System

Examples of liabilities include bank loans, mortgages, accounts payable, deferred revenues, accrued expenses, and so on. A chart of accounts is a catalog of account names used to categorize transactions and keep your business’s financial history organized. The list typically displays account names, details, codes and balances.

Organize account names into one of the four account category types

If the company is large and has very many divisions, this code is expanded to a 3-digit code, enabling the inclusion of more than 99 subsidiaries. Non-operating revenue refers to the sales the company makes from other secondary sources. Discounts and deductions for returned merchandise are also included as part of the business’s revenues. For instance, the operating expenses of a retailer include the cost of goods sold along with the selling, general, and administrative expenses.

A chart of accounts is a small business accounting tool that organizes the essential accounts that comprise your business’s financial statements. Your COA is a useful document that lets you present all the financial information about your business in one place, giving you a clear picture of your company’s financial health. To better understand how this information is typically a chart of accounts usually starts with presented, you may want to review a sample of financial statement. This can help you visualize how your chart of accounts translates into formal financial reporting. There are five main account type categories that all transactions can fall into on a standard COA. These are asset accounts, liability accounts, equity accounts, revenue accounts, and expense accounts.

A second benefit to the organization of a chart of accounts is that you can use this information for investment opportunities. This lets prospective investors or shareholders determine your business's financial health via the financial information provided. As part of the equity accounts, retained earnings serve as an indicator of the company’s financial health and its capacity to generate profits for continued growth.

Like I mentioned above, the chart of accounts is a flexible financial organization tool, so you will seldom find a company that has the exact same charts of accounts as another company. The purpose of a COA is to organize the company’s finances, segregating its expenditures, revenue, assets, and liabilities in order. In addition to assisting with financial statement creation, there are other advantages to using a chart of accounts.

Your accounting software should come with a standard COA, but it’s up to you and your bookkeeper or accountant to keep it organized. Here are tips for how to do this, plus details about what a COA is, examples of a COA and more. In this article you will learn about the importance of a chart of accounts and how to create one to keep track of your business’s accounts. A chart of accounts is a critical tool for tracking your business's funds, especially as your company grows.

Each account in the chart of accounts is usually assigned a unique code by which it can be easily identified. This identifier can be numeric, alphabetic, or alphanumeric, with each digit/letter typically representing the type of account, company division, region, department and other classifiers. In conclusion, integrating your Chart of Accounts with accounting software like QuickBooks Online significantly improves the efficiency and accuracy of financial management. By setting up a well-structured COA in the software and integrating third-party applications where necessary, businesses can optimize their financial management processes and make better-informed decisions.